Bank credit risk management pdf

(SBICRM) State Bank Institute Of Credit And Risk Management, Plot no. 77, Sector-18, Gurugram as per Schedule-I, to this agreement and has caused Drawings, Bills of Quantities and Specification describing the work to be done, prepared by SBIIMS,

Commonwealth Bank of Australia Investor presentations Risk Management –Credit Risk Alden Toevs Group Chief Risk Officer 16th and 17th November, 2010

Risk Management . Course Module in Corporate Financial Management . Course Modules help instructors select and sequence material for use as part of a course.

credit risk a bank incurs by virtue of loan creation. The Basel Committee on Banking Supervision (BCBS) defined credit risk as the probability that a bank borrower will fail to meet its obligations in accordance with agreed terms or the possibility of losing the outstanding loan partially or totally due to credit events (Iwedi, & Onuegbu, (2014). Poor credit administration reduces bank

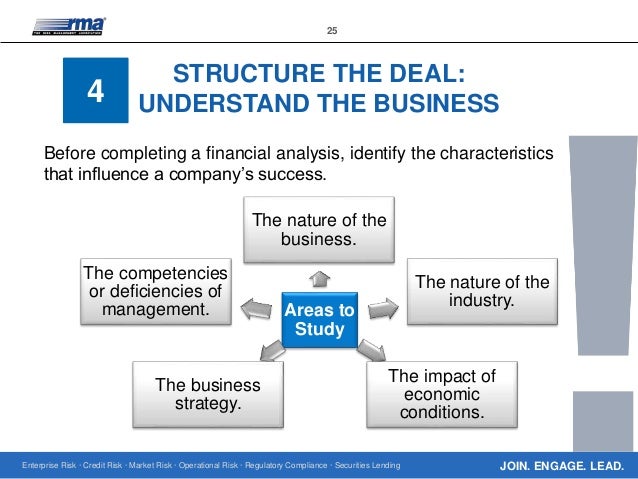

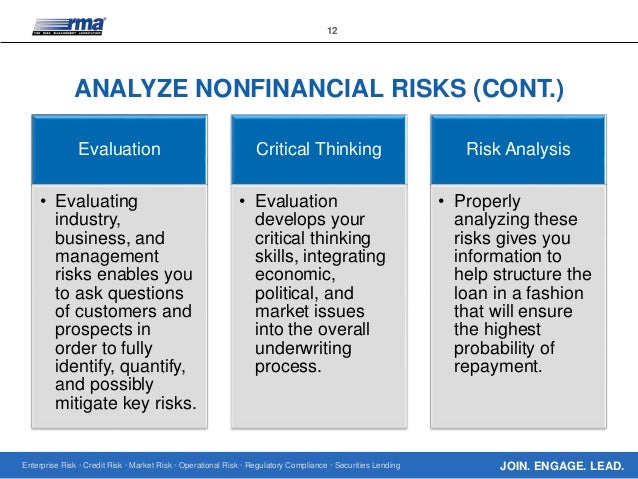

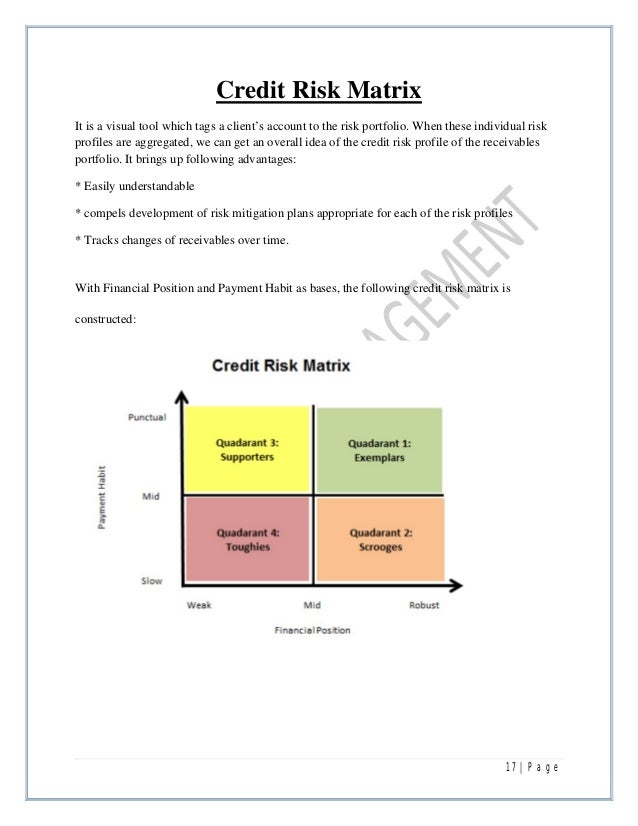

Effective credit risk management process is a way to manage portfolio of credit facilities. Credit risk management encompasses identification, measurement, monitoring and control of the credit risk exposures. The effective management of credit risk is a critical component of comprehensive risk management and essential for the long term success of a banking organisation. 2. Literature …

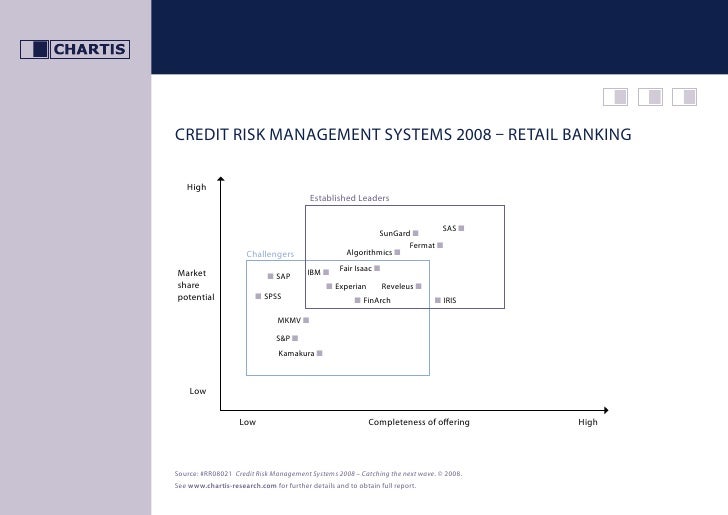

A number of financial institutions have collapsed or experienced financial problems due to inefficient credit risk management systems. The study seeks to evaluate the extent to which failure to

The credit risk management framework exists to provide a structured and disciplined process to support this objective. The framework is top down, being defined, by Credit Principles and Policies.

Historically, credit risk was lodged mainly in the banking book. However, with the growth in holdings of corporate securities and derivatives, credit risk in the trading book has increased. Diversification is a first line of defence against major credit losses. In the banking book, diver-sification is used to avoid concentration of credit risk with a particular borrower, or group of borrowers

On the other hand, a bank with high credit risk has high bankruptcy risk that puts the depositors in jeopardy. Among the risk that face banks, credit risk is one of great concern to most bank authorities and banking regulators. This is because credit risk is that risk that can easily and most likely prompts bank failure (Achou, 2008). The very nature of the banking business is so sensitive

The Credit Risk Management Committee ( “CRMC” ) is the principal senior management committee that supports the CEO and the Board in general credit risk management

• Market & Credit Risk are transactional, substitutable, arbitrageable, inseparable • Op Risk is corporate, top-down, about Infrastructure and Reputation • But it is also inseparable from other Risk-types, and substitutable

Contents 4 1. 2015 In brief 7 2. Risk organisation 15 3. Capital management 29 4. Credit risk 47 5. Counterparty credit risk

Federal Reserve Bank of Atlanta Components of a Sound Credit Risk Management Program. LOAN POLICY The loan policy is the foundation for maintaining sound asset quality because it outlines the organization’s default risk tolerances, states terms to mitigate exposure at default, and provides key controls to help the lending institution identify, manage, and report risk mitigation. Generally

Bank Credit Management ‘BANK CREDIT MANAGEMENT’ provides information to on-the-job bankers regarding how to handle credit operations. Starting from Credit policy, it covers the appraisal techniques for term loan, working capital and non-fund based loans with cases studies. It also covers the credit risk management techniques with cases studies. Besides, it provides details about credit

Risk Management s3.amazonaws.com

STATE BANK INSTITUTE OF CRDIT AND RISK MANAGEMENT

More Stories

Base sas prep guide pdf

Blackmores professional duo celloids pdf

Books about human behavior pdf